Bangladesh’s inward remittances rise 17% in December

- Update Time : Tuesday, 2 January, 2024, 03:00 pm

- 95 Time View

Online Desk :

Bangladesh has maintained the upward trajectory of remittance inflows, raking in nearly $1.99 billion in December, a year-on-year increase of 17.07 percent. It was the highest in a single month since the start of the fiscal year in June. In December 2022, Bangladesh received nearly $1.7 billion in remittances. The country has taken in $10.79 billion in remittances in the first half of the 2023-24 fiscal year, according to the update provided by Bangladesh Bank on Tuesday. It was a $305 million, or 2.9 percent, jump from the $10.49 billion over the same period in the 2022-23 fiscal year. Bangladesh began 2023 with an increase in remittance inflows, according to central bank data. But it declined in February. It fluctuated in the following months before the foreign exchange situation stabilised near the end of fiscal year 2022-23. Bangladesh ended the year with remittances totalling $21.61 billion, a 2.75 percent increase year-on-year.

That trend seems to have continued into the current fiscal year. However, the July to December period was not without its issues. The income sent home by expatriate workers in July stood at $1.79 billion. In August, Bangladesh took in nearly $1.6 billion, a 21.47 percent decline year-on-year. It dropped further in September to $1.34 billion. Remittances rebounded in October to nearly $1.98 billion, a 30 percent jump year-on-year, amid the rising price of the dollar and initiatives to increase incentives. The upward trend continued into November, which saw an inflow of 1.93 billion, a 21 percent year-on-year increase. Remittances began to decline in the first half of 2022 as the Russia-Ukraine war further exacerbated the global economic downturn.

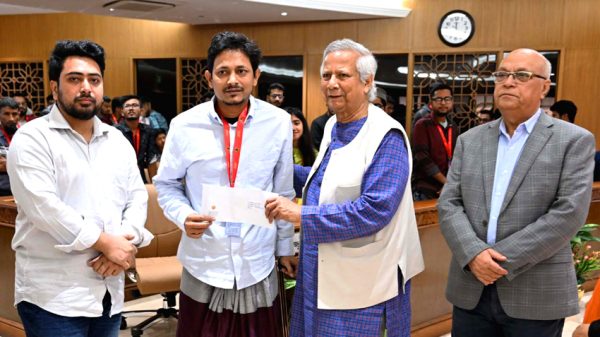

To encourage expatriate workers to send remittances home through official channels, the Bangladesh government increased the cash incentive rate from 2 percent to 2.5 percent. Afterwards, scheduled banks started stacking up to 2.5 percent in incentives on top. The government also relaxed conditions for sending remittances, easing the process. When these initiatives seemed to have relatively little impact on inflows, central bank Governor Abdur Rouf Talikder blamed illegal hundis. Economists have blamed the large gap in dollar rates between banks and the open market for the issue. The highest rate in the banking channel is Tk 110, but it hovers around TK 120 in the open market. Businesses have complained that they are not able to buy dollars at the bank rate. The price for dollar imports remains above Tk 120.