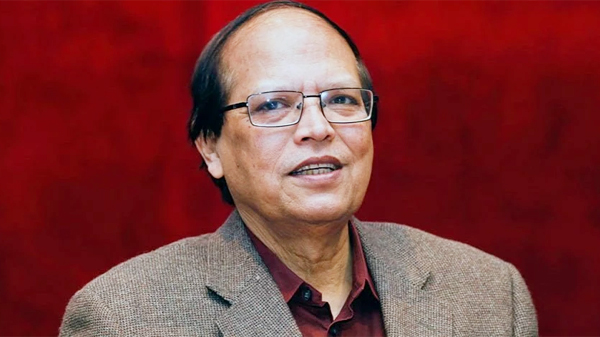

Economy bears brunt of ongoing blockades and hartals ahead of polls: Dr Atiur Rahman

- Update Time : Thursday, 23 November, 2023, 05:57 pm

- 83 Time View

Online Desk: In an interview with the UNB former governor of Bangladesh Bank Dr. Atiur Rahman has explained how the current spate of blockades and burning of vehicles are taking a toll on the economy and suggested ways for reaching a solution.

Dr Atiur, currently honorary professor at Department of Development Studies in Dhaka University, said the fear of setting fire to the carriers is real.

The protests have been called by BNP, Jamaat and some smaller allies, to protest the announcement of the schedule for the 12th parliamentary elections for January 7. The opposition demands that Prime Minister Sheikh Hasina steps down and hand over power to a neutral administration to make the vote free and fair. The government has rejected the demand as unconstitutional.

The economist said because of the protests the cost of transporting items for both domestic consumption and exports has gone up.

Also, most of the drivers and helpers have lost jobs as the vehicles aren’t plying on the roads. These are mainly temporary jobs and thousands have been badly affected by this continuous political unrest, he said this week.

He said the ongoing unrest has not only been disrupting the domestic supply chains but also impacting the international supply chains as the inter-district truckers and container vehicles cannot move on the streets.

While the agricultural producers are not getting the prices of their products due to this transport disruption the urban consumers of the same are being forced to pay higher prices, he pointed out.

The unrest with threats of torching and attacks on the vehicles and shops has already created a situation where business confidence is gradually shrinking. This is having a huge impact on the levels of investment, according to Dr Atiur.

The banks are also worried about the likely defaults of their loans as businesses are facing huge challenges. As the NBR chair has rightly pointed out this political unrest along with the slowdown of imports will have a significant impact on the collection of revenues, he pointed out.

This again has an impact on the budget deficit and subsequent need for higher public borrowing. The inflation situation may worsen in such a complex situation. The country faced a similar crisis in 1914 and it was quite difficult for the regulators and government to pull back the economy on track following the political unrest.

‘We managed to come out of this culture of burning …subsequently leading to robust economic growth. However, the country is facing a negative culture of burning its assets after a long time. I hope good sense will prevail among all the stakeholders to avoid another round of political uncertainty and unrest leading to undesired loss of the economy.’ Dr Atiur said.

The foreign exchange crisis is likely to be prolonged if the political unrest continues like this. Both imports and exports are getting the hits from supply-side disruptions and cancellations of orders from the buyers, he observed.

‘’Also, the foreign direct investment is likely to be negatively affected if this political stalemate continues for a longer time. All these have both direct and indirect implications for the balance of payments which is already under severe pressure,’ he said.

The first best solution will be to get all the political parties onboard the election train at any cost. If needed, the Election Commission may be more flexible in its schedule to attract more parties into the election process.

Even if some parties still avoid the election train even after such adjustments let it move on with the candidates from contesting parties and individuals who are participating as independents.

In the meantime, “we must continue to move further towards market-determined solutions in making both exchange rates and interest rates flexible to bring back our macroeconomic stability.”

Simultaneously, the central bank should try to attract more medium-term foreign exchange loans or deposits from friendly central banks of the region to bolster reserves.

Apart from this, the central bank must make its best efforts to attract more remittances through official channels by providing some more incentives to the small remitters and providing higher returns to fix dominated NRB bonds for the large remitters, said Dr. Atiur.